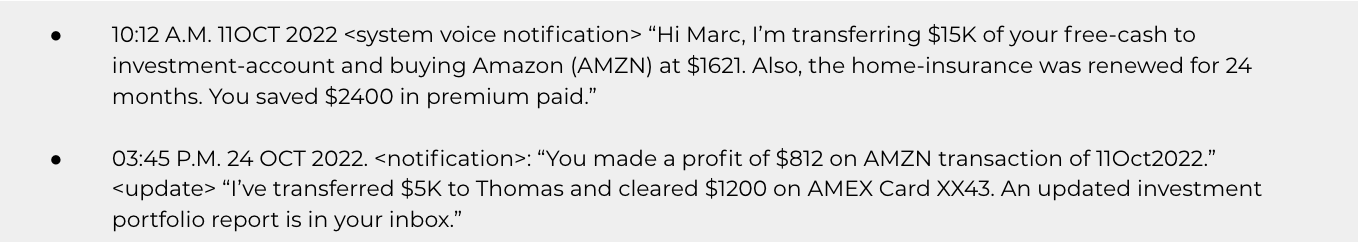

Imagine a world of 'self-driven finance', which automates and improves much of our’ financial decisions and outcomes. Not a fictional scenario but a very real possibility in the near term. Platform and processing power, data abundance, and advances in AI models are bringing us closer to a world where machines can do most of the things we thought only humans could do.

These Intelligent-Assistants will work 24/7 to provide superior returns on our idle-money while mitigating risk. Also, recurring tasks such as bill payments, subscription renewals, and insurance will be automated to free-up consumers’ time and attention as algorithms make decisions on our behalf.

The future of banking is a world without banks! Too radical? Let’s simplify it.

Introducing Self-drive finance

Autonomous finance reimagines the whole idea of financial services delivery by integrating technology at the heart of each system.

Using AI and Machine Learning, ‘Autonomous Finance’ can remove human input from decision making, enabling every customer to have a virtual private banker making all financial decisions for them.

As the financial-services industry rapidly modernizes with the introduction of real-time fund transfers, the proliferation of mobile apps, deployment of chatbots and AI-based solutions to manage customer complaints as well as API-led banking, the era of a customer making decisions about their money is behind us.

Future applications will be designed around every customer’s unique journey, specific portfolio, and financial needs. The goal is to improve fund allocation, bring efficiencies and reduce the possibility of human error by letting advance algorithms run tasks such as portfolio management or bill payment automation.

The digitization of everything and “changing consumer expectations” is transforming digital-finance. The millennial' consumers already trust recommendations generated by AI on how to manage their finances.

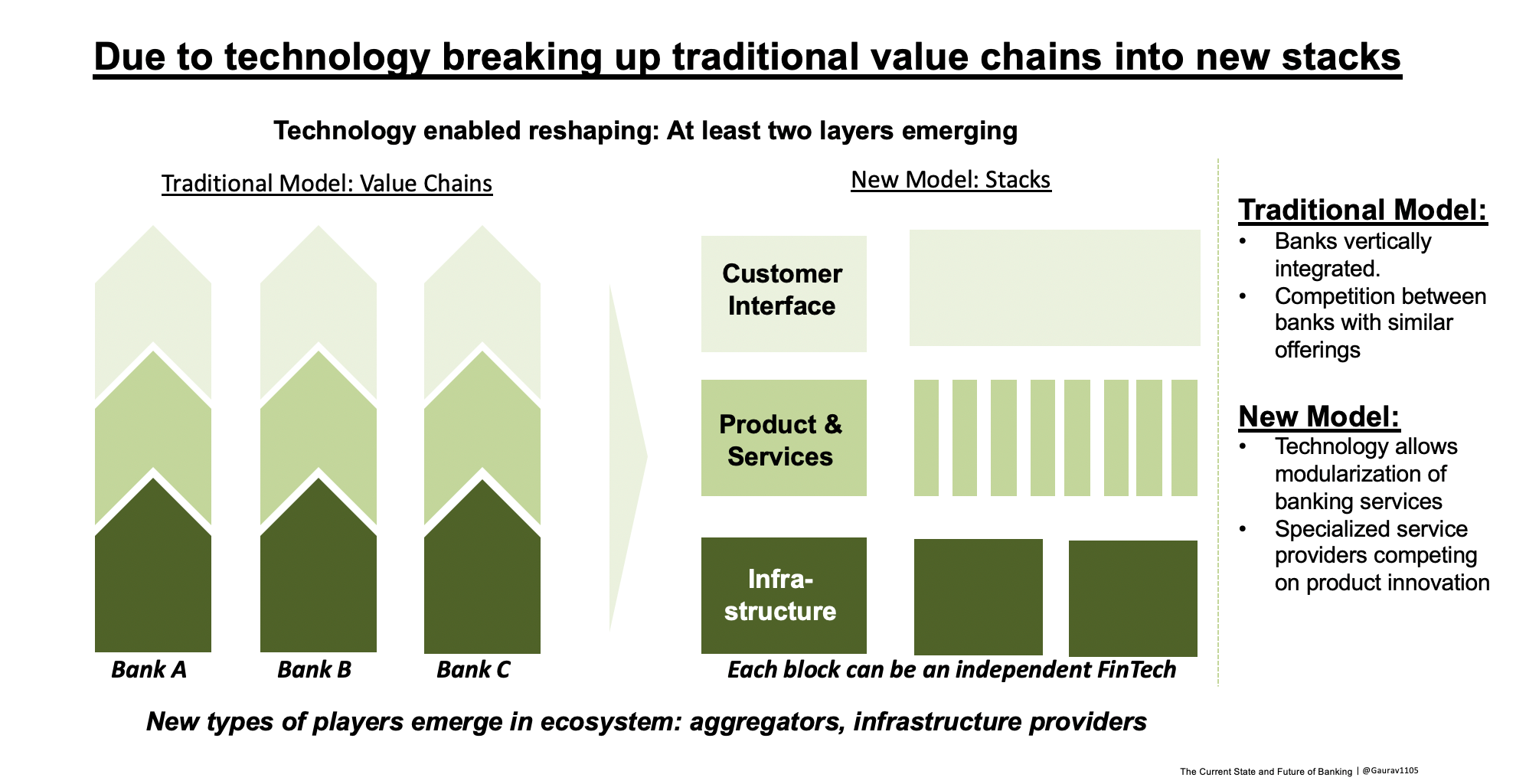

The bonds that have historically held together financial institutions are weakening, and the operating models are being fundamentally reshaped.

Autonomous-Finance is likely to have a massive impact on the ‘hidden’ cost of data and information asymmetries. Let’s take India, for example, the entire banking industry retail-assets base is ~$350–370bn, however, consumers are losing (approximately):

- $10bn on higher borrowing costs in mispriced loans.

- $8bn in higher premium costs for Insurance.

- $10–20bn in lost interest income on ‘idle-cash’ in the bank account.

Man and the Machines: “Systems of Intelligence”

Even though humans historically - on the foundations of trust and legacy, have run the banking functions- the introduction of machines has changed the playing field.

First, the rise of ATMs made customers brand agnostic as long as they could cash out at convenience. Then came the internet banking, where customers can quickly initiate money transfer or investment transactions from the comfort of their phone.

We are currently in the third wave of digitization where intelligent algorithms are beginning to control everything from lighting in the living rooms to the temperature of our coffee. Why should finance be left behind?

Imagine interacting with an “intelligent application” which advises you on personal finance, reallocates your investment portfolio according to your life-stages and goals. At the same time, it makes sure you don’t miss a bill by setting up auto-pay for all bills while considering the importance of maintaining a consistent level of liquidity for you.

These “Systems of Intelligence” companies will create massive value. The value will not come from the “intelligence” alone. The value is in the system itself.

Technology platforms are shifting. Financial transactions have moved away from legacy infrastructure to innovative buy-and-build models where supply chain financing happens through blockchain, mortgage onboarding happens through AI, and the risk analysis of portfolio happens every millisecond with reallocations taking place through robo-advisors.

This makes it possible to reimagine product, service and consumer experience stack in a 360-degree fashion to ensure that money works for people autonomously in a ‘self-drive’ mode.

There is a whole new set of interesting ways to re-think the customer experience around boring old products.

“The arrival of true autonomous finance will be the companies that provide the connective tissue between these sometimes competing needs, automatically monitoring and adjusting your financial roadmap over the course of your lifetime. “- Angela Strange

The future is already here.

In the era of ‘invisible banking’ and ‘autonomous- finance’, the handling of finances will be outsourced to thousands of algorithms working seamlessly across a suite of services to provide an integrated and hassle-free experience.

The application will realign to refinance our debts when it’s most advantageous in terms of interest rates and arbitrage opportunities. The system will invest our cash into longer-term investments (and rebalance them) when it makes the most financial sense. Life insurance and other such payments will be on autopilot, bills will be automatically paid and subscriptions managed seamlessly.

Already, the line between deposits and lending is getting blurred and automation will further erode this distinction further as ‘cash-flow will be delivered as a service’. Non-traditional data is opening up new vistas in this domain and cash flow-based lending models are now possible which serve new customer categories and markets.

The line between deposits and lending will become blurred as cash-flow is delivered “as a service”. Non-traditional data makes it possible to serve new customer categories and markets.

— Gaurav Sharma (@Gaurav1105) October 1, 2019

While there’s a lot to look forward to when automated finance becomes everyone’s lived reality, the way things shape up will also depend on how regulations & policy evolve.

A clear vision of the future financial landscape is critical to good strategic and governance decisions as financial institutions around the world face growing competitive pressure to make major strategic investments in AI, and policymakers seek to navigate the challenging regulatory and social uncertainties emerging globally.

AI-driven finance: The challenge for fintech is one of consumer trust.

With data proliferation and real-time data sharing across geographies, the data sovereignty laws might need to be revisited. At the same time, the fiduciary status of entities will have to be aligned with the legalities of the algorithms.

Other issues that will crop up during the course of regulating the world of autonomous finance relate to digital identity, data privacy, transparency of practices and intellectual property rights.

While AI-driven finance seeks to make lives easier and money management more efficient, the big challenge staring us (fintech companies) is that of establishing consumer trust. Consumers will seek to reward companies with their business which maintains transparency in policies, data integrity, and communication.

Establishing consumer trust is a pivotal point in the journey of ‘autonomous-finance’ as it’ll determine the long-tail of products and services.

“Technology goes beyond mere tool making; it is a process of creating ever more powerful technology using the tools from the previous round of innovation.” –Ray Kurzweil

The paradigm shift in the nature of Money ( from CowryShells to BitCoin)

Money is undergoing evolution. Paper money is a relatively new invention. In the near future, our most important financial decisions will be taken autonomously by computers and algorithms that we trust and rely on.

The future experience of a consumer will be centered around machine-driven finance where financial lives are automated and financial outcomes improve greatly.

The factors (PRICE, SPEED, ACCESS) that were important to Incumbent financial institutions in remaining competitive are reaching equilibrium, and reducing their’ ability to differentiate.

As it frees financial institutions from the need to make trade-offs between better service and cost, Autonomous-finance models will give rise to a new set of competitive factors (CUSTOMIZATION, EXPERIENCE, ECOSYSTEM) on which financial institutions can differentiate.

The line between deposits and lending will become blurred when “cash-flow is delivered as a service”. Models become better as more data is generated, but the prediction value of any individual model and system tends to plateau. The key is to establish a link between better models and better products. Non-traditional data makes it possible to serve new customer categories and markets.

Also, the demarcation between spending, borrowing and wealth management will break down as one service-based offering manages the flow of customers’ money across multiple accounts.

Deposit accounts are no longer the locus of control for customers as the center of the retail customer experience shifts to financial-management platforms. The creation of new connections between capital and assets will result in new pools of capital to access alternative assets.

Deposit accounts are no longer the 'locus of control for customers' as the center of the retail customer experience shifts to Consumer-fin-tech-management platforms, reducing interaction points between large banks and customers.

— Gaurav Sharma (@Gaurav1105) July 25, 2019

Technical breakthroughs happen slowly and then suddenly. People were actively working on mobile computing a decade before the iPhone. We underestimate how long it takes for a breakthrough technology to fully develop and get adoption, but we also underestimate the scale of disruption.

We are in the early phases. Change is coming and it’s coming fast and it’ll only accelerate.

Gaurav Sharma is a finTech entrepreneur and currently building a Bank of the Future for Consumers and SMB’s.