Banking is at an inflection point. Technology giants such as Google, Apple, Facebook, Amazon, and Alibaba (GAFAA) are redefining the customer experience and increasingly becoming serious about financial services.

The digitization of everything and the “shifting of consumer expectations” are creating the next wave of digital transformation.

Changing customer expectations across generations and the rapid acceleration of “digital” throughout the entire value chain in banking is putting pressure on the long-standing sources of revenue, growth, and retention.

“But often it is not the competition right in front of us that we should be most worried about”

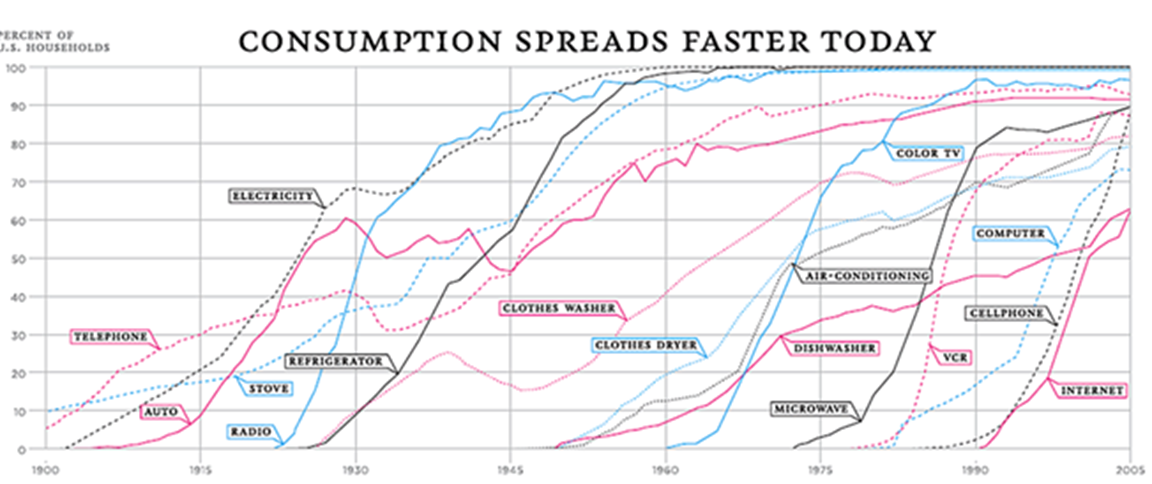

Technology Adoption is Quicker Than Ever

The transition from discs to downloads and streaming transformed the music industry. The introduction of the iPhone further transformed the music and camera industry. We are witnessing a similar seismic shift that is reshaping the centuries’ old banking business model.

For instance, looking through the narrow lens, the leaders at Kodak and Nokia could never understand that the threat from Apple’s iPhone was much broader. Similarly, in the year 2000, Wal-Mart Inc. could not have predicted the impact of Amazon.com on its business.

With acceleration and convergence in technology over the past five years, experiential digital competitors have grown in importance. These companies offer products or services that, while not physically similar to your bank’s services, provide an experience that effectively replaces it.

Non-Banks are Defining Customer Experience and Reference Points

Customer experiences often seep from one industry to an entirely different one. For example, consider how customers increasingly check the way their credit card cancellation is handled against their most recent Amazon.com return and compare their bank branch visit to a visit to the Apple Store’s Genius Bar.

Similarly, Uber with its superlative frictionless application has “re-set” the expectation a user has from any other mobile app performance. For this very reason, businesses that fail to understand these expectations will find themselves fundamentally disrupted by competitors they never saw coming.

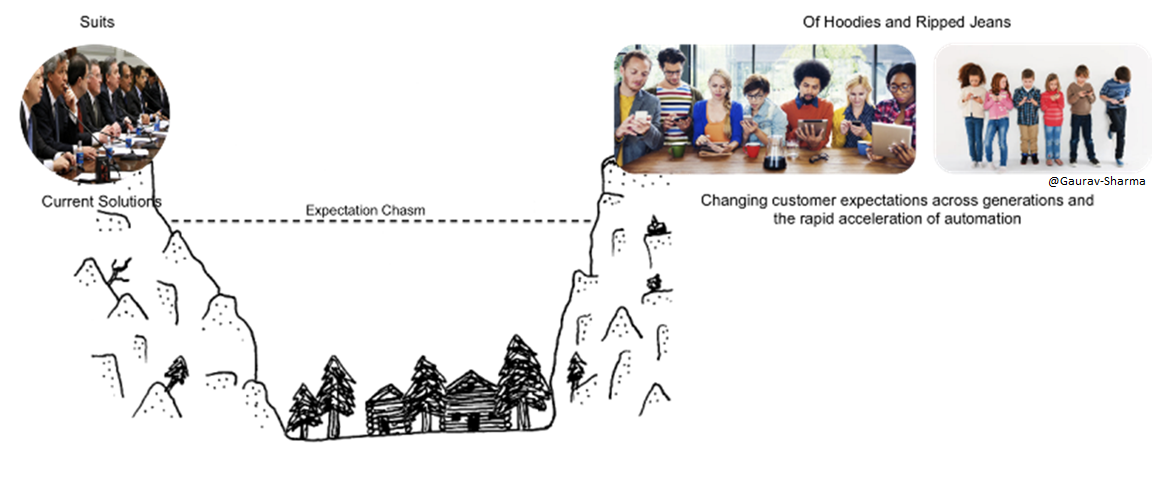

Transcending the “Expectation Chasm”

Banks today are facing a broader competitive threat than they have experienced to date. Customer experiences in any category now affect how customers experience products in other categories previously thought to be unrelated. Traditionally, banks focused on outperforming direct competitors or companies that offered products similar to their own. But now, consumer expectations are starting to transcend traditional industry boundaries. Not only are brands benchmarked against their industry peers, but also against great customer experiences companies offer in other sectors.

The average age of senior leaders in a bank is 48 years, while the average age of bank consumer is 28 years or lower.

Over the next decade, this divergence will only increase. The average banking customer profile is changing dramatically as Generations X and Y assume more significant roles in the global economy. The Millennials (those born between 1980 and 2000) are already creating radical shifts in consumer demographics, behaviors, and expectations.

Maybe it’s the result of a generation raised on Harry Potter, but Gen Y is hard to surprise. Spending 90% of their time online on Facebook, Snapchat, Venmo, Instagram, and Google, they expect services to be magical and relevant, and to constantly surprise and delight them. Hence, what was seen as incredible by banks only five years ago is considered just average today. Gen Y’s preference for a state-of-the-art customer experience, speed, and convenience are further accelerating the adoption of FinTech solutions.

Disruption of the banking industry is happening, and Consumer-Tech is the driver.

Rapid advancements in core technology stacks, artificial intelligence and data sciences are ‘widening this chasm’ further.

Overcoming the challenge is hard, even more so when the leadership is from a branch based, pre-digital world. Also, sometimes senior management’s “employee think” limits the “entrepreneur think.”

Don’t get me wrong, the banks are full of very smart people doing a great job. But what they’re dealing with is a huge amount of legacy; the legacy of technology, the legacy of processes, and the legacy of thinking. For example, most of the tech platforms (in banks) are mainframes designed for a different era, to run branches when batch processing payments overnight were okay.

Another example of structural inefficiency is that banks, by definition, create products that are in competition with each other; cards and loans are competing, as are investments and savings. As a result, different parts of the organization are not able to think along the lines of customer need as they’re focused very much along product lines.

Most banks still treat “digital” like a channel, and are therefore missing out on the holistic opportunity.

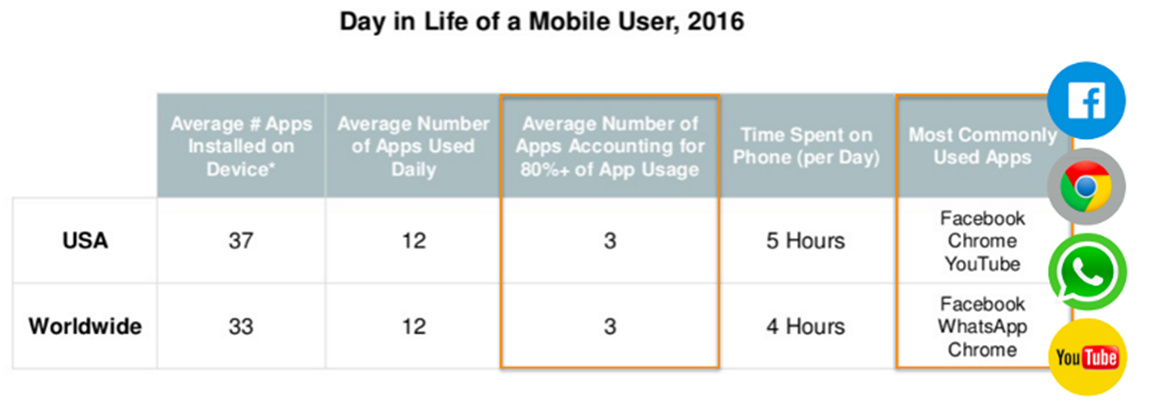

Consumption Pipes and Platforms Influencing User Behavior

This is where the “digital natives” are spending their time:

Some of the channels fuelled by millennials are:

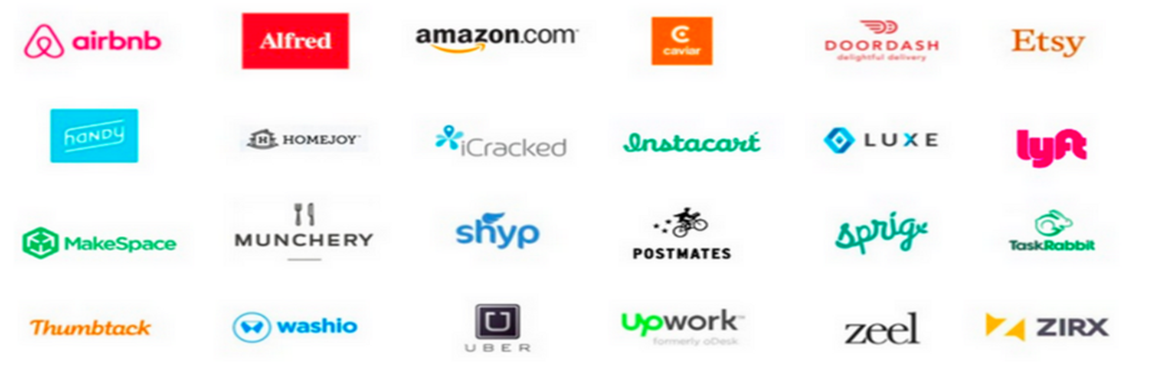

Customer Centricity is Fueling Disruption

FinTech and other Consumer-Tech companies are driving the wave of disruption with solutions that can better address customer needs by offering tailored products, enhanced accessibility, and convenience. In this context, Millennials are bringing a higher degree of “customer centricity” to the entire financial system, an expectation shift that is crystallized in the DNA of FinTech companies. No surprises, then, that almost 75% of consumers believe their relationship with their bank is only transactional — that is, they have “neutral or negative loyalty” to the bank.

Consumers are Setting a Different Bar for Experiences

As customers become accustomed to the digital experience offered by companies such as Apple, Google, Amazon, and Facebook, they expect the same level of customer experience from their financial service providers.

Branch traffic is consistently decreasing. More and more applications are coming in digitally, and consumers expect to complete transactions with little or no interaction with a live person. This transformational shift in banking is driving more routine transactions to self-service options.

Consumers are also getting increasingly picky. For example, the majority of them want:

1. To monitor all their accounts in one place.

2. To move money how and when and they want.

3. To access their accounts and services anywhere, anytime.

4. Banking to be easy and work smoothly.

5. Security & Control.

Now, contrast your banking and digital product offerings with those from new FinTech and consumer tech companies. This shift clearly demonstrates the skill-gap of bank employees required to deliver to “digital” customers.

“If the rate of change on the outside exceeds the rate of change on the inside, the end is near” — Jack Welch

As banks face increased pressure to further reduce costs and drive more profitable relationships with their customers, the large technology (such as PayPal, Amazon, and WhatsApp) and platform players (such as Messenger, WeChat, Apple Pay) are beginning to offer a more attractive set of rails on which to deliver services to customers.

At the moment, banks are set up to be very risk averse, partly because of all the issues with regulators, whereas ‘digital’ by definition is about taking risk and seeing whether things work.

Having survived the financial crisis of 2008, banks today are confused about their purpose. On one hand, costs and regulation have risen, which means the only way to improve profits is to cut more costs. On the other hand, a crop of small, regulation-averse companies is trying to pick off bank functions and customers.

Only recently have some of the earlier FinTech companies started to face some rough weather. Although it’s likely that some of these small FinTech companies will die or be subsumed into the bigger maw, one can’t underestimate the long-term impact of their ideas.

Banks today have three major challenges — outdated technology, not enough streamlined data insights, and silos between business groups.

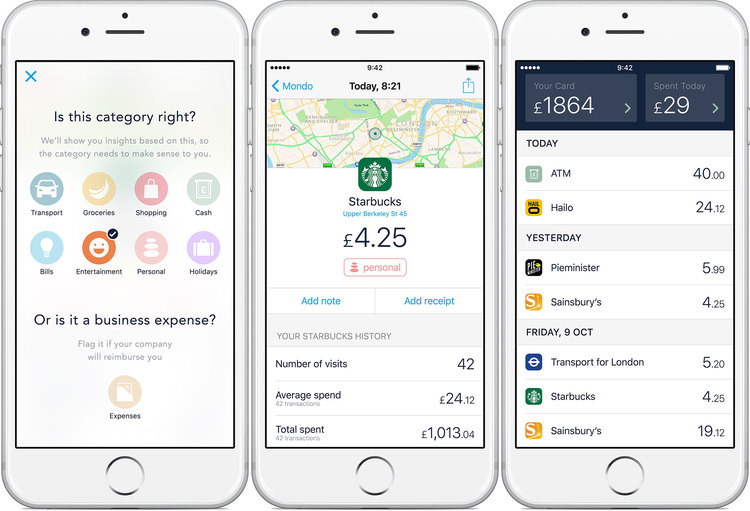

Successful Businesses are Moving from Design Thinking to Design Doing

Technology is changing how companies are organized and run across all industries and banking is no different. For many traditional financial institutions, this approach will require a fundamental shift in their identity and purpose. The new paradigm will involve turning away from a linear product push approach to a customer-centric model in which banks are facilitators of a service that enable clients to acquire advice and interact with the relevant actors through multiple channels.

It’s about setting up the right cultures, the right structures, and the right level of flexibility to deliver on design thinking. The most recent design and tech trends in UX and UI are also pointing in a clear direction.

Neo-banks and FinTech’ startups — Mondo, Moven, Abra, Messenger Pay, Venmo, Affirm, and WeChat — have completely altered the landscape and the customer experience.

By focusing on incorporating new technologies into their architecture, traditional financial institutions can prepare themselves to play a central role in a new world in which they can operate at the center of customer activity and maintain a strong position. It might be worthwhile to consider a BaaS (Banking as a Service) model.

“You probably never thought of Uber as an acquirer of small business bank accounts, but if you’re an Uber driver, and Uber can give you a debit card that enables you to get paid — then why would you go to a bank branch to open an account instead?” — Brett King

Banks should try to make the most of their position of trust with clients, brand recognition, access to data and knowledge of the regulatory environment to build capabilities.

“Contextual data analytics will introduce more intelligence into each customer contact, laying the groundwork for augmented intelligence towards the end of the decade.” — Chris Skinner

The change to new ways of working can also be made by bringing in those who have the experience doing it elsewhere, such as people with digital and design experience and individuals who have grown up familiar with the technology and services that drive the modern banking experience.

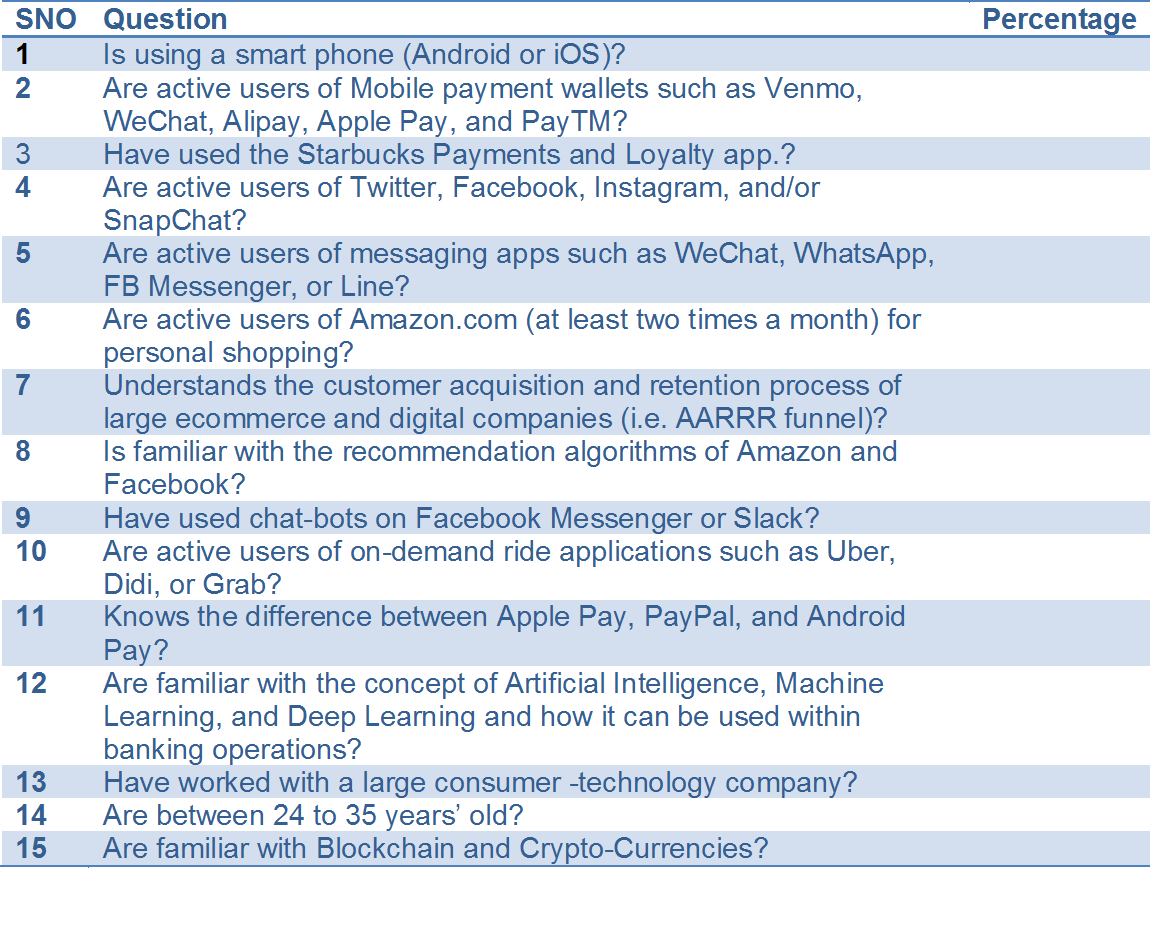

Overcoming “We Know Better” Syndrome and the Understanding Gap

Unfortunately, some bank leaders still suffer from “We Know Better” syndrome. Here is a quick test I recommended to check your bank’s readiness to cross the “expectation chasm” discussed above. Bank CEO’s should do this exercise for the top 5% bank employees and the entire management team by asking these simple questions:

What Percentage of the Bank Management and Leadership Team:

And most important, is there a full time and dedicated ‘Head of FinTech’ in the organization?

In Summary

The banks are struggling and the battle is on for the Holy Grail — “Customer Ownership”. Consumer experience technology is changing faster than the banks’ ability to innovate, resulting in an “expectation chasm.” This is further exacerbated by an impending demographic change in consumer population. Customer experiences with any product category now affect how customers experience products in other categories previously thought to be unrelated.

New age FinTech players with no legacy constraints are nibbling away at the profitable customer segments. Additionally, tech giants such as Amazon, Google, and Apple, with a large user base, are continuing their expansion and are positioned to play a major role in the financial services ecosystem in the same way that Tencent and Ant- Financial are doing it in China.

Ultimately, the customers only care about convenience, trust, and experience. They do not care whether you are a bank or a fin-tech company.

The future holds big wins or rapid failure depending on the choices financial institutions make today as we undergo this shift in banking from “Where do you bank?” to “How do you bank?”

The bank needs to ask the uncomfortable question: “Why do we exist?”